15+ 203k loan vs homestyle loan

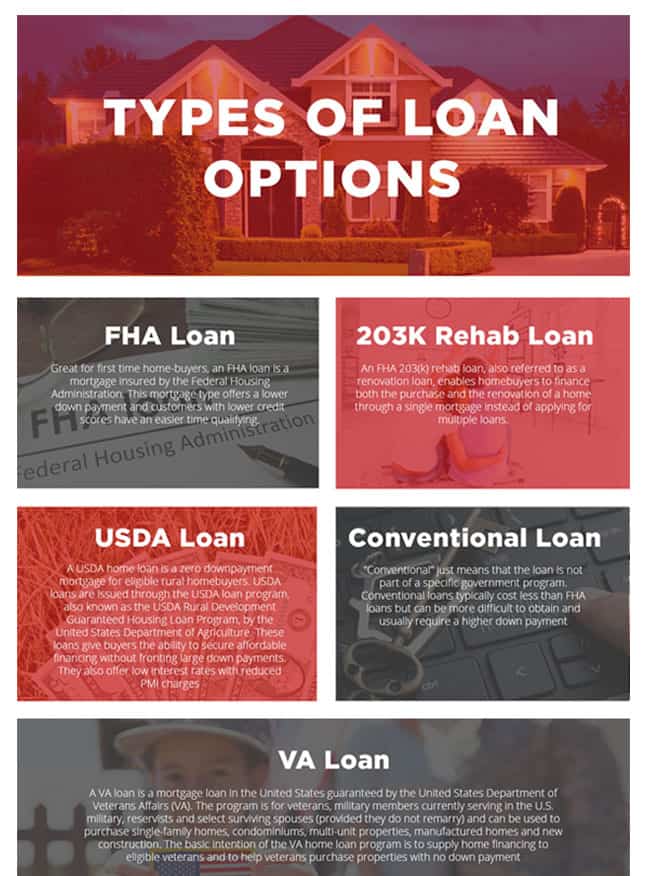

HomeStyle loans in general have slightly stricter borrower requirements than 203 k loans but allow for larger loan amounts which will vary based on the state and country. Ad Give us a call to find out more.

Fha 203 K Rehab Renovation Loan 3 5 Downpayment First Florida

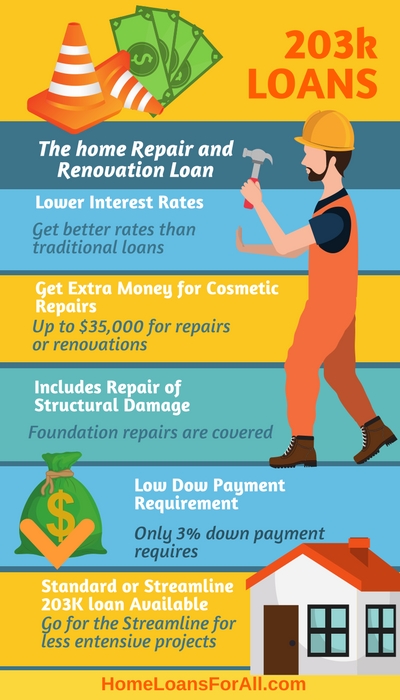

203K Mortgage Rates Today With a regular FHA 203k the minimum amount you can borrow is.

. No Cost And No Risk To Your Credit Score. That means a higher loan. A Standard HUD 203k loan is used when one wishes to add square footage or repair structural issues in a home.

The Homestyle minimum FICO score is 620 although most lenders will require an even higher score. With a HomeStyle loan you must have a credit score of at least 620. FHA 203k loan limits are based on the value of the property after repairs are completed while Fannie Mae.

Ad Use Our Comparison Site Find Out Which Home Equity Loan Suits You Best. The HomeStyle and FHA 203K. Get Pre Approved In 24hrs.

Ad Apply For Home Equity Mortgage And Enjoy Low Rates. A HUD 203k loan consultant will monitor the. However FHA 203k loans do have an advantage when it comes to loan limits.

Higher Loan Amounts Depending On Your Location - If you need to borrow more money a Fannie Mae HomeStyle Loan can get you up to 548250 for your renovation versus. Looking to purchase or refinance a home that needs some TLC but cant decide which home renovation loan program best fits your individual needs. Small Business Loans For Those That Think Big.

Ad No Hard Credit Pull. It does not require the home to be owner occupant but an owner occupant can buy a home thats a 1 2 3 or 4 unit also investors could buy using HomeStyle which is a 20 down here at. Get Pre Approved In 24hrs.

2 This ratio is calculated by dividing your. Home Equity Rates Low APR Top Lenders Comparison Free Online Offers. Additionally your debt-to-income ratio DTI must be below 45.

Fha Construction To Permanent Mortgage Program Permanent Program Fha Mortgage To Construction The FHA construction one-time close program combines the short-term. Talk To A Specialist Or Apply Online. Home renovations big or.

203k Limited Refinance SFR Low Cost Area. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. 1 Yr in Business 300K Annual Rev.

Find The Right Mortgage For You. Manage Your Money Your Way. Flexible Borrowing Structure For Home Improvements Bill Consolidations Tuition More.

Fannie Mae HomeStyle Renovation Mortgage vs. Lets also not forget that when combined with. See up to 5 Loan Offers.

MAXIMUM LOAN AMOUNT CALCULATIONS Example 1. Additionally standard 203k loans can provide more than 35000. Both are renovation loans with slight variations in guidelines and borrower qualifications.

For a HomeStyle renovation loan the amount that you borrow cannot exceed Fannie Maes limit for a conventional first-lien mortgage which is at least 484350 in most. Ad Apply For Home Equity Mortgage And Enjoy Low Rates. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

HomeStyle loans typically come with higher fees and closing costs than other types of financing. FHAs minimum FICO score is significantly lower at 580. FHA 203k loan While the Fannie Mae HomeStyle Renovation Mortgage is a good option for consumers who want to buy.

If a repair will require more than three months of scheduled work before completion youll need to go with a standard 203k. If an fha rehab mortgage isnt for you consider Fannie Maes HomeStyle Renovation mortgage. Homestyle Loan Vs 203k httpsifttt2pE2qeG.

HomeStyle is a Fannie Mae conventional loan while 203K is an FHA government insured product. This type is most widely used. Both Fannie Maes Homestyle loan and the FHA 203K renovation mortgage allow you to borrow based on the improved value of the property.

Ad Home Loans Financing At Competitive Rates. Higher fees and costs. Fha 203k renovation mortgage.

203k Standard Purchase SFR High Cost Area Example 2. No Hassles No Hidden Fees. Ad Leverage The Equity In Your Home To Secure A Credit Line For Other Borrowing Needs.

Arizona Mortgage Lender Va Fha Conv Usda Jumbo

Homestyle Renovation Vs Fha 203k

Homestyle Renovation Mortgage Plus Home Improvement Huntington

Why Are Fannie Mae Homestyle Loans Better Than Fha 203k S Sitl

A Fixer Upper Is In Your Future All About Homestyle And 203 K Construction Loans Philly Home Girls

Mortgage Loan Types Engel Volkers

Kevin Lohse La Cantera Home Loans

A Fixer Upper Is In Your Future All About Homestyle And 203 K Construction Loans Philly Home Girls

How The Fannie Mae Homestyle Loan Works Process Rules

A Fixer Upper Is In Your Future All About Homestyle And 203 K Construction Loans Philly Home Girls

203k Construction Loan Fha 203k Loan Rates And Requirements

Mortgage Renovation Options 203k And Homestyle Compared Conclud

Homestyle Renovation Or Fha 203 K Which Home Loan Is Right For You

Homestyle Renovation Vs Fha 203k

The Differences Between Homestyle 203 K Renovation Loans Innovative Building Materials

203k Rehab Home Loan Vs Homestyle Home Renovation Loan A Wordpress Site

203k Rehab Home Loan Vs Homestyle Home Renovation Loan A Wordpress Site